While the world was recovering from the recession of 2008, a new currency ‘bitcoin’ was introduced as the ‘cryptic concept’. The underpinned blockchain technology was unknown to the investors back then. However, with time, cryptocurrency has gained huge popularity and acceptance. Today, the crypto market capitalization stands at one trillion dollars and is predicted to only increase in the future.

Today, cryptocurrency has emerged as a global phenomenon, which was once merely a concept. Investors and institutions started showing interest in cryptocurrency investment. There are several cryptocurrency exchange platforms available for investors like PayBito which consists of popular cryptocurrencies for investors. If you are new to the crypto community, you need to understand what crypto exchange is, and how these platforms work.

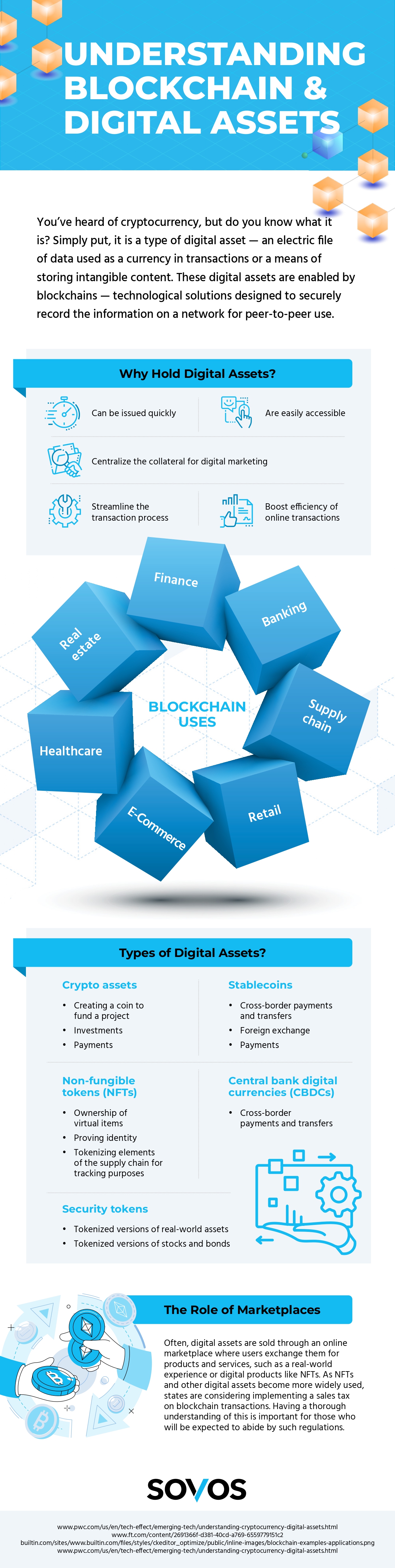

Provided By Tax Software Company, Sovos

What is Crypto exchange? How Does it Work?

Cryptocurrency investments take place in exchange platforms that allow you to buy crypto using fiat money or cryptocurrency. These platforms are used to sell and buy crypto and act as an intermediary between the buyer and seller.

Many people use exchange platforms to invest in crypto, for its low trading fees. Since not all platforms are beginner-friendly, it may overwhelm beginners who have limited knowledge of trading stocks. Therefore, it is crucial to understand the type of crypto exchange, how it works, and the best platform for you to invest in.

Institutional entrepreneurs willing to start their own trading platform can avail PayBito’s white label crypto exchange architecture. It helps you to set up a customized readymade trading platform that can be easily deployed in the market saving precious time and capital.

Types of Crypto Exchange

There are more than six thousand cryptocurrencies, with three hundred exchange platforms worldwide. Choosing the best platform can be intimidating. However, understanding the platform types may ease the process. There are two types of crypto exchange platforms:

-

Centralized Exchange Platform: The common exchange platform that uses third parties or intermediaries to conduct transactions. the investors rely on the third party for security and help them find the best matches for trading partners.

-

Decentralized Exchange Platform: in decentralized exchange platforms, there are no in-betweeners. Instead, the platform is underpinned by blockchain technology that enables users to conduct peer-to-peer transactions using smart contracts.

A Step-By-Step Guide To Invest In Crypto

Before randomly choosing a platform to invest in crypto, it is important to read the guide and do proper research. Here are seven steps to make a successful investment using crypto exchanges.

Step 1: Understand the Asset Class Before Investing

Before making any hasty investment, it is important to understand that crypto is a volatile market, and can be a risky investment. However, many have earned high-profit margins by conducting thorough research of the asset class that attracts them, and the need to invest in it.

Experts suggest a thumb rule for investors and suggest only investing 5% to 10% of the portfolio in cryptocurrency. Although investing in crypto is similar to investing in stocks, however, the two have their differences. Many cryptocurrencies have emerged in the market and completely disappeared within a few years. Therefore, it is critical to invest only what you can recover, as you may lose it all.

Step 2: Choose the Currency You Want to Finance

There are more than six thousand cryptocurrencies available in the market. Some of the popular currencies are bitcoin, Ethereum, Shiba Inu, Dogecoins, etc. Here are some of the crucial factors that will help to choose the right cryptocurrency for investment.

-

Market Capitalization: One of the initial research while selecting crypto for investment, is to check the market capitalization of the currency.

-

Current Supply & Mining Limitations: It is important to check the number of crypto coins that are already circulated in the market.

Some cryptocurrencies have limited mining, which means after reaching a certain limit, the existing coins will be circulating in the market. For example, bitcoin mining is limited to 21 million, and already 18,7 million coins are circulating the market.

-

White Paper: every cryptocurrency has its own whitepaper that consists of the purpose of the coin, the technology it uses, and so on. For beginners, white papers can help to get in-depth details about the cryptocurrency’s purpose, and the vision of the founder.

-

Applications: Although, white papers consist of all the details associated with the currency, understanding the applications of the currency will help to estimate the increase in value of the coin in the future.

Step 3: Choose the Right Platform To Invest

Conventional banks and financial institutions do not offer cryptocurrencies. These are available only from crypto exchange platforms, where investors can perform tasks like buying or selling crypto., in exchange for a minimum fee. Investors can buy directly from the exchange or from another peer holding the currency. It is crucial to understand that trading with crypto is entirely anonymous.

Step 4: Store Your Cryptocurrencies

There are two types of crypto wallets where cryptocurrencies are stored, hot wallets, and cold wallets. While the hot wallets are connected to the internet, the cold wallets are offline. Since the wallets are software-based, it is only available digitally, making it a complex procedure.

These wallets consist of private and public keys to the blockchain network where the crypto is stored. Any investor will require public and private keys to store their assets. There are various digital wallets available online for crypto storage.

Step 5: Secure Your Wallet

Keeping your cryptocurrency safe is a crucial aspect for investors. Users can use cryptocurrency to buy real-life products, which is why crypto wallets play an important role. Therefore, for online wallets, security is a huge concern. Investors use VPN (Virtually Private Network), which ensures encrypted and secure transactions. Data encryption ensures that online transactions are protected.

In Conclusion

The Crypto market is nascent in comparison to other investment options. Every day, new tokens are introduced in the market. With the growing crypto community, various money laundering cases, and scams are reported which is why it is crucial to keep security as the top priority and invest wisely.

More Stories

Simple Tool for Planning Your Mutual Fund Investments: SIP Calculator

Understanding Nifty 150 Momentum 50: A Comprehensive Guide for New Investors

Why Mutual Fund Investment Apps are the Smart Choice?